What Do Your Taxes Pay For?

Taxes are one of the biggest budget items for most taxpayers, yet many have no idea what they’re getting for their money.

In 2017, as in recent years, Americans spent more on taxes than on groceries, clothing, and shelter combined. In fact, we worked until late April just to earn enough money to pay our taxes. So what do all those weeks of work get us?1

Fast Fact: In the Hole. In fiscal 2018, the federal government will spend $804 billion more than it collects in revenue. The government borrows the funds it needs to cover this shortfall by selling Treasury securities and savings bonds.

Source: Congressional Budget Office, 2018

Source: Congressional Budget Office, 2018

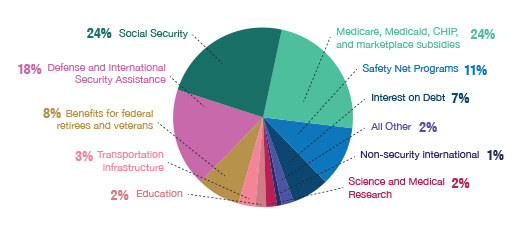

The accompanying chart breaks down the $3.95 trillion in federal spending for 2017 into major categories. By far, the biggest category is Social Security, which consumes one-fourth of the budget. Income security, which includes food assistance and unemployment compensation, takes another 13%. Defense and related items take 15% of the budget, and 28% goes to Medicare and health programs.2

Are taxes one of your biggest budget items? Take steps to make sure you’re managing your overall tax bill. Please consult a tax professional for specific information regarding your individual situation.

Pieces of the Federal Pie

More than 60% of 2017 federal spending was used for Social Security, Medicare, defense, and related programs.

Source: Pew Research Center, 2018

- Tax Foundation, 2018

- Pew Research Center, 2018